Standard Reset: Iraq’s Gold Reserves Quadruple In Latest 2 Months!!

Richard Nixon

Iraq Quadruples Gold Reserves In Two Months -

Gold will be supported by the strong likelihood that central banks will continue buying bullion after data showed Brazil boosted its reserves for a third month, Russia continued to diversify into gold and Iraq entered the gold market for the first time in many years and quadrupled their gold reserves in just two months.

Brazilian holdings expanded the most in 12 years, rising 14.7 metric tons in November. The nation’s holdings doubled since August. Russia’s bullion reserves increased by 2.86 tons to 937.8 metric tons in November.

Central banks have bought 426.5 tons of gold so far this year.

Iraq quadrupled its gold holdings to 31.07 tonnes over the course of three months between August and October, data from the International Monetary Fund showed on yesterday.

The IMF’s monthly statistics report showed the country’s holdings increased by some 23.9 tonnes in August to 29.7 tonnes.

That was followed by a 2.3-tonne rise in September to 32.09 tonnes and then a cut of 1.02 tonnes in October to 31.07 tonnes. There was no data for November.

It is Iraq’s first major move in years to bolster its gold reserves.

More recently, Brazil raised its gold holdings by 14.68 tonnes, or 28 percent, in November, bringing its bullion reserves to 67.19 tonnes.

The addition comes on the heels of an even bigger increase in October when the South American country added 17.17 tonnes to its reserves. In September, it increased holdings by 2 tonnes.

The central bank of Iraq’s quadrupling of gold reserves is important as there are many oil rich nations in the world with sizeable dollar and euro currency reserves and only a small allocation to gold by these central banks alone could lead to higher gold prices.

The smart money will continue to dollar cost average and buy gold on dips.

Zero Hedge

Brazilian holdings expanded the most in 12 years, rising 14.7 metric tons in November. The nation’s holdings doubled since August. Russia’s bullion reserves increased by 2.86 tons to 937.8 metric tons in November.

Central banks have bought 426.5 tons of gold so far this year.

Iraq quadrupled its gold holdings to 31.07 tonnes over the course of three months between August and October, data from the International Monetary Fund showed on yesterday.

The IMF’s monthly statistics report showed the country’s holdings increased by some 23.9 tonnes in August to 29.7 tonnes.

That was followed by a 2.3-tonne rise in September to 32.09 tonnes and then a cut of 1.02 tonnes in October to 31.07 tonnes. There was no data for November.

It is Iraq’s first major move in years to bolster its gold reserves.

More recently, Brazil raised its gold holdings by 14.68 tonnes, or 28 percent, in November, bringing its bullion reserves to 67.19 tonnes.

The addition comes on the heels of an even bigger increase in October when the South American country added 17.17 tonnes to its reserves. In September, it increased holdings by 2 tonnes.

The central bank of Iraq’s quadrupling of gold reserves is important as there are many oil rich nations in the world with sizeable dollar and euro currency reserves and only a small allocation to gold by these central banks alone could lead to higher gold prices.

The smart money will continue to dollar cost average and buy gold on dips.

Zero Hedge

We are on the brink of something the majority of people in the world are not prepared for. The complete elimination of fiat money and a return to a gold standard. The US Treasury and the US Mint are walking the same fine line that the CFTC is walking as they try to slowly introduce position limits on gold and silver COMEX contracts. Nobody wants to ROCK THE BOAT and get blamed for the crash, but all are preparing for the END of fiat money.

It’s only a matter of time. -Bix Weir

It’s only a matter of time. -Bix Weir

Rothschild’s Residence Of Waddeson Manor.

Rothschild’s Plan For Transference Of Wealth & Power From The U.S. To Himself!

The Rothschild Gold Must Be Disgorged!

Yes, it all started in earnest in 1971 when Richard Nixon unconstitutionally removed the USD from the gold standard. This allowed the Rothschild’s British ‘City Of London’ Gang to begin flooding the U.S. market with worthless newly printed USD paper. This Rothschild ulterior plan would: 1) Subjugate the people to a welfare state, 2) Remove The U.S.’s sovereign power as the leader in the world 3) Abscond The U.S.’s military power to destroy Middle East States that were on a gold standard 4) Remove their gold into London.

- Rothschild IS The Receiver Of The United States Bankruptcy: The Rothschild International Bankers, The United Nations, The World Bank, & The Rothschild IMF.

- World Financial Market To Be Rebalanced By Currency Revaluation!

Once this was accomplished and Nation States were flooded out by their own currency through bailout schemes. Rothschild simply through his matrix of banking cronies, resets currencies back to the gold standard where he is now in charge instead of The United States Of America. This is what is called The New World Order by the ‘father of the mafia’ Rothschild. The mafia never originated in Italy (thats hollywood stuff), it originated in Britain by the Rothschild’s and moved this modus through countries like Italy. Why Italy, because The Roman Catholic Church is Rothschild’s mortal enemy.

Once this was accomplished and Nation States were flooded out by their own currency through bailout schemes. Rothschild simply through his matrix of banking cronies, resets currencies back to the gold standard where he is now in charge instead of The United States Of America. This is what is called The New World Order by the ‘father of the mafia’ Rothschild. The mafia never originated in Italy (thats hollywood stuff), it originated in Britain by the Rothschild’s and moved this modus through countries like Italy. Why Italy, because The Roman Catholic Church is Rothschild’s mortal enemy.

Breaking: Rothschild’s City Of London ‘PAPER’ Banking Cabal Implodes: But The Rothschild GOLD Reset Is Just Beginning!

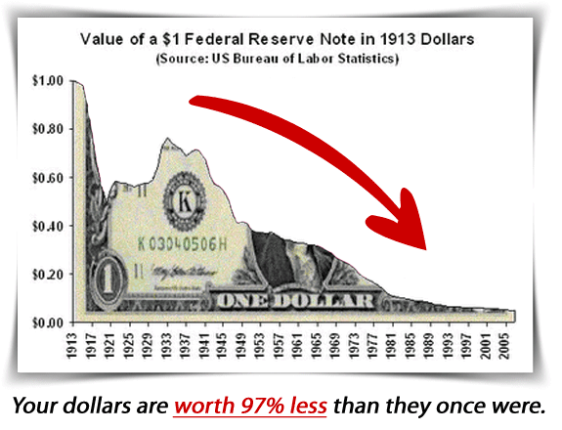

Now think about this for a minute. For nearly 100 years, when the U.S. dollar was on the gold standard, its value fluctuated less than 5% from its high to its low. However, in the 41 years after the U.S. dollar was taken off the gold standard, the U.S. dollar has lost 97% of its value!

Where did the value go? It went into trillions and trillions of newly printed dollars that Americans now have to work off in the next 30+ years or so with less jobs and higher medical taxation. Where’s the GOLD? Good question ~ many have assumed it being spirited away to London.

The U.S. is a battle field of murders, mini ponzi schemes, faked suicides, orchestrated false flags, demonization of family unity, out right lying by the media, control of the media by the cabalists, out right lying by the putative president, supplying arms to the mexican drug cartel by Obama/Holder/Hillary, violation of the war powers act by Mccain/Lieberman/Graham, violation of miranda rights, violation of taxation laws by john Robert’s of USSC to pass obamacare, murder of judges, violations by judges, prevention of candidates Ron Paul, transferring 2012 presidential election ballots to George Soros a known felon’s company in Spain, and all on an unprecedented scale etc. etc.

Remember, the price of gold really doesn’t go up or down. It’s very stable. Most people think that gold has gone up over the last 10 years, what has really happened is that the U.S. dollar has gone down.

Gold Vs Us Dollar

We perceive the drop in the value of the dollar in terms of how many dollars it costs to buy goods and services today versus back in 1971 when the dollar was on the gold standard.

In 1971, a loaf of bread cost $0.25 but today it costs $1.15.

In 1971, a gallon of gas cost $0.36 but today a gallon of gas costs $3.90.

In 1971, a postage stamp cost $0.18 but today a postage stamp costs $0.45.

In 1971, a new house cost $40,000 but today a new house costs $165,000 even after the biggest decline in real estate prices even with the Great Recession of 2008.

You can read more about how inflation has impacted the costs of goods and services at inflation adjusted price of gold.

If you were to buy a brand new corvette convertible today, it would cost you $55,000. In gold, that would be roughly 32 ounces of gold at the spot price of $1700 per ounce. So when gold is at $1700 per ounce, you could buy a brand new corvette convertible for about 32 1-ounce gold coins if you cashed them in. If the U.S. dollar was still on the gold standard and you remove inflation, that same car would have a gold standard value of only about $800. So if that car is selling for $55,000 and the gold standard value is $800, that means that we have about $54,200 worth of inflation over the last 41 years on a $800 item.

Back in 1964, a quarter would buy you roughly a gallon of gas. That’s because quarters made in 1964 and earlier were made with roughly 90% silver and 10% copper. So the spot price of silver being roughly $31 an ounce, that makes that same quarter from 1964 worth almost $5.63. It takes about 5.5 silver quarters from 1964 and before, to make up about an ounce of silver. So the same 1964 and earlier quarter (in terms of silver value) will buy about 1.5 gallons of gas. Practically the same amount of gas that it did back in 1964 and even a little more! However, it today’s inflated dollars, it would take 15 quarters to buy a gallon of gas!

The price of gold may fluctuate with the vale of the dollar but it doesn’t change the fact that precious metals like gold and silver retain their value throughout time. The only thing that changes is the value of the currencies that are not tied to the value of gold and silver.

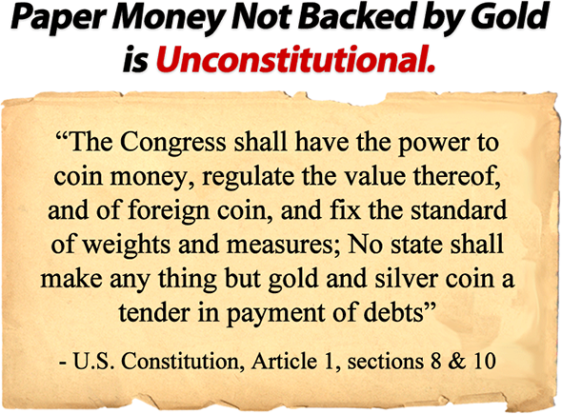

This is what the founding fathers warned us about and tried to prevent from happening with the Constitution.

What you need to understand is that the excess printing of the U.S. currency is just another tax on the American people. It takes the value of the dollars that people have, and makes them worth less in the long run. Meanwhile, you are still making roughly the same amount of money yet the price of everything from gas to milk are going up constantly when in reality, nothing is really going up in price but instead the actual value of the dollar is dropping.

Gold Retirement Plan

Where did the value go? It went into trillions and trillions of newly printed dollars that Americans now have to work off in the next 30+ years or so with less jobs and higher medical taxation. Where’s the GOLD? Good question ~ many have assumed it being spirited away to London.

The U.S. is a battle field of murders, mini ponzi schemes, faked suicides, orchestrated false flags, demonization of family unity, out right lying by the media, control of the media by the cabalists, out right lying by the putative president, supplying arms to the mexican drug cartel by Obama/Holder/Hillary, violation of the war powers act by Mccain/Lieberman/Graham, violation of miranda rights, violation of taxation laws by john Robert’s of USSC to pass obamacare, murder of judges, violations by judges, prevention of candidates Ron Paul, transferring 2012 presidential election ballots to George Soros a known felon’s company in Spain, and all on an unprecedented scale etc. etc.

Remember, the price of gold really doesn’t go up or down. It’s very stable. Most people think that gold has gone up over the last 10 years, what has really happened is that the U.S. dollar has gone down.

Gold Vs Us Dollar

We perceive the drop in the value of the dollar in terms of how many dollars it costs to buy goods and services today versus back in 1971 when the dollar was on the gold standard.

In 1971, a loaf of bread cost $0.25 but today it costs $1.15.

In 1971, a gallon of gas cost $0.36 but today a gallon of gas costs $3.90.

In 1971, a postage stamp cost $0.18 but today a postage stamp costs $0.45.

In 1971, a new house cost $40,000 but today a new house costs $165,000 even after the biggest decline in real estate prices even with the Great Recession of 2008.

You can read more about how inflation has impacted the costs of goods and services at inflation adjusted price of gold.

If you were to buy a brand new corvette convertible today, it would cost you $55,000. In gold, that would be roughly 32 ounces of gold at the spot price of $1700 per ounce. So when gold is at $1700 per ounce, you could buy a brand new corvette convertible for about 32 1-ounce gold coins if you cashed them in. If the U.S. dollar was still on the gold standard and you remove inflation, that same car would have a gold standard value of only about $800. So if that car is selling for $55,000 and the gold standard value is $800, that means that we have about $54,200 worth of inflation over the last 41 years on a $800 item.

Back in 1964, a quarter would buy you roughly a gallon of gas. That’s because quarters made in 1964 and earlier were made with roughly 90% silver and 10% copper. So the spot price of silver being roughly $31 an ounce, that makes that same quarter from 1964 worth almost $5.63. It takes about 5.5 silver quarters from 1964 and before, to make up about an ounce of silver. So the same 1964 and earlier quarter (in terms of silver value) will buy about 1.5 gallons of gas. Practically the same amount of gas that it did back in 1964 and even a little more! However, it today’s inflated dollars, it would take 15 quarters to buy a gallon of gas!

The price of gold may fluctuate with the vale of the dollar but it doesn’t change the fact that precious metals like gold and silver retain their value throughout time. The only thing that changes is the value of the currencies that are not tied to the value of gold and silver.

This is what the founding fathers warned us about and tried to prevent from happening with the Constitution.

What you need to understand is that the excess printing of the U.S. currency is just another tax on the American people. It takes the value of the dollars that people have, and makes them worth less in the long run. Meanwhile, you are still making roughly the same amount of money yet the price of everything from gas to milk are going up constantly when in reality, nothing is really going up in price but instead the actual value of the dollar is dropping.

Gold Retirement Plan

No comments:

Post a Comment