Fearing Collapse of the Euro

European bankers and top politicians fear a collapse of the Euro

August 11, 2012 – ECONOMY – Until recently, it was a sign of political correctness not even to consider the possibility of a euro collapse. Investment experts at Deutsche Bank –Germany’s largest bank — now feel that a collapse of the common currency is “a very likely scenario.” Germany’s second-largest bank — Commerzbank — has also flagged fears of a Eurozone collapse whilst bracing for a worsening of the euro-crisis.

“The greatest downside risk remains an uncertainty shock from an escalation of the sovereign debt crisis, ie, the collapse of the monetary union,’ Commerzbank states in its latest quarterly report released this week, adding that it thought the risk was higher now than in autumn last year. Italian Prime Minister Mario Monti has also warned of the “psychological break-up” of Europe if the euro crisis is not soon resolved.

Spain and Italy, the two chief trouble spots, are threatened with a financial collapse that could tear the 13-year-old currency union apart and rock the global economy. The World Bank has also warned that the euro collapse could spark a global crisis. It isn’t easy to predict how such a tornado would affect the global economy, but it’s clear that the damage would be immense.

Is the euro about to fall further, possibly leading to serious concerns about a devaluation spiral of the European single currency? Over the last three months, the euro has lost around 5 percent of its value against a basket of major currencies. Against the US dollar, it has lost around 8 percent. Is there a need for a clearer signal that the Eurozone debt crisis has now reached the global currency markets?

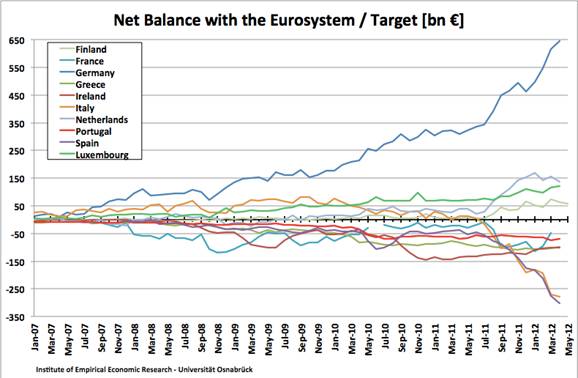

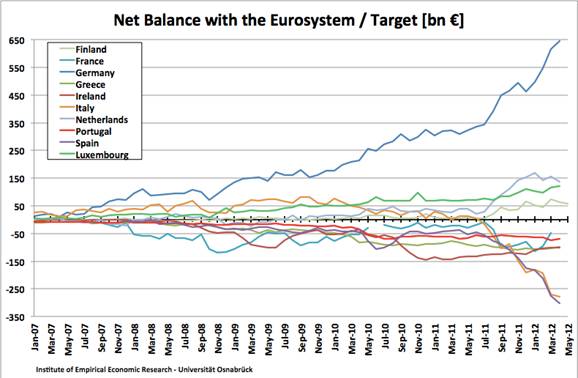

The second phase started in July 2011 when tensions spread to Italy and Spain, and this “shock to confidence” was followed by a “sharp change” in investment flows as foreign private investors started cutting exposure not just to Italy and Spain but also to Belgium, France and even Germany. In Greece, Ireland, and Portugal, foreign deposits have fallen by an average of half, and foreign government bond holdings by an average of one third, from their peaks.

Whilst the Eurozone crisis is much more complicated and likely to be protracted, during the 1997-98 South East Asian financial crisis there was substantial flight of capital from those countries. The third phase of the crisis has now begun and it shows a remarkable new element: domestic investors in the Eurozone are starting to push more money abroad, in a dynamic like the ones we have witnessed in traditional emerging market currency crises like the Asian and Latin American crises.

Residents knew the changing nature of risks and rewards earlier than non-residents. Several months ago, capital outflows from the peripheral Eurozone countries prompted a worldwide dialogue about the significance of the balances of the European payments system known as Target2, as the euro-system –particularly the German Bundesbank –took over the financing of these private capital outflows. Economic deterioration, ratings downgrades and especially a Greek exit would almost certainly significantly accelerate the timescale and increase the amounts of these outflows from the Eurozone, turning the process into a step-by-step stampede.

Residents’ attempt to be the first ones to exit was subsequently identified as the likely cause for precipitating that crisis. As the capital flight accelerated, in parallel, there was a sudden and palpable loss of confidence throughout South East Asian economies.

Is the Eurozone mirroring some of the defining features and significant milestones of the South East Asian financial crisis and collapse? There are growing signs with every passing week that the crisis of confidence in the Eurozone is assuming an ever larger new dimension. For some weeks, it has been apparent that capital is no longer simply flowing from the southern countries to the core countries of the Eurozone, particularly Germany, but actually heading offshore. –Market Oracle

No comments:

Post a Comment